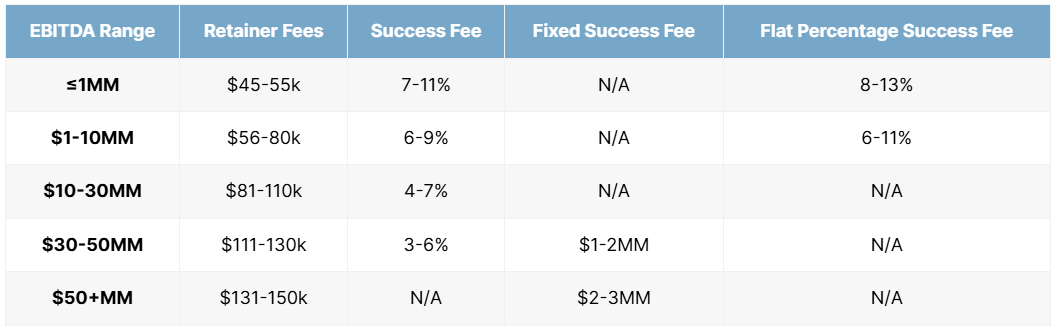

M&A Advisory Fee Structure

The table below provides average fees as expressed by EBITDA.

M&A Advisory Fee Break Down

Different fee types used and explanations as to how they work in an M&A advisory relationship.

Retainer Fees

Fixed amounts charged up-front to ensure that the owner is committed to the process. As the advisory firm does its work, the retainer is drawn down.

Success Fees

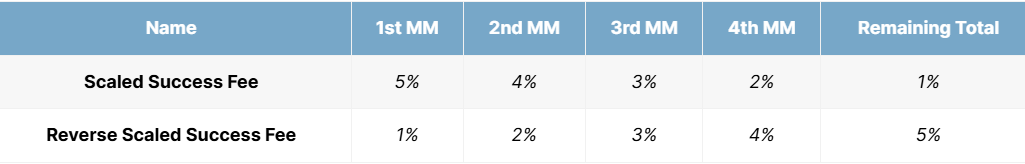

Fees paid to the selling firm upon closing. May be fixed, flat percentage, scaled, or reverse scaled. There are two types of success fees.

Fixed Fee

A success fee in the form of a predefined dollar amount, distributed at closing. Often used in deals that require minimal work to close.

Flat % Fee

A success fee in the form of a percentage of the company’s enterprise value upon closing.

Success fees can also be presented as “scaled” and “reverse scaled,” meaning a certain percentage is added for every million earned during closing.

The Lehman Scale

Fees/Timing

Our success fees are based on a percentage of the total transaction value, payable when the deal is closed. Our fee schedule is comparable to that of other leading merger and acquisition intermediaries.

To partially cover the work shown in the timeline below we also charge a monthly retainer fee. We represent either the buying or the selling side in any given transaction and are never paid by both parties.

Week 1-5

Plan strategy and conduct internal due diligence

- Understand company and its objectives

- Review and restate operational and financial performance

- Review and sharpen growth projections

- Develop preliminary marketing strategy

- Value propositions

- Types of buyers

- How broadly to market

Week 6-9

Prepare memorandum and identify buyers

- Define key selling points

- Prepare offering memorandum

- Identify and evaluate potential buyers

- Customize approach for strategic and financial buyers

Week 10-15

Conduct formal marketing efforts

- Contact buyers

- Distribute memorandum

- Qualify buyers and furnish information

- Prepare management presentation

- Receive preliminary indications of interest

Week 16-22

Conduct management presentations and buyer due diligence

- Select qualified buyers

- Facilitate meetings and plant visits

- Coordinate follow-up information requests and discussions

Week 23-24

Evaluate bids and assist negotiations

- Evaluate offers

- Assist in negotiations

- Facilitate due diligence and legal documentation

- Close transaction

Committed To Your Success

Whether you are navigating a business acquisition, sale, or capital raise, our team ensures that every transaction is executed with expertise, discretion, and a results-oriented approach.

Questions? Ask An Expert

© 2025 | Crestline Capital Partners, Ltd. | All Rights Reserved | Privacy Policy

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.